THE NEXT GENERATION OF MEDICAL BILL REVIEW

It’s easy to get comfortable in a thriving market. But how much are you overpaying for health care every year?

Specialty Bill Review

Bill review has advanced. Has your solution kept pace?

The growth in high-cost claims and medical overbilling has shifted the reimbursement landscape. Solutions once “good enough” aren’t good enough anymore.

$42,000

and Rising

That’s the average cost of a workers’ comp medical bill. And it’s inflated by overbilling.

With the industry’s most advanced analytics and physician review process, Comp 42 has transformed bill review. We protect your company like no one else from the silent yet pervasive corrosion of high-cost claims and overbilling.

Satisfied with your current savings? Then you’ll be even more satisfied saving more—both money and time.

Comp 42 offers:

- Unsurpassed savings and a savings guarantee.

- Faster resolution to drawn-out provider disputes.

- Freedom from the liability of disputed claims as we take them off your books.

Comp 42 takes every bill through a meticulous evaluation to prevent overpayment. We audit for errors, waste, and abuse, apply precise repricing when needed, and confidently stand by the savings we deliver, ensuring our work holds up under scrutiny.

Don’t let your bill review solution be on the wrong side of history. Or your business results.

Specialty Bill Review

BE SURE YOU’RE NOT OVERPAYING IN A WORLD OF OVERBILLING

See how Comp 42 can save you money, especially around high-dollar claims, with the industry’s:

- Most advanced medical bill review (advanced analytics + physician expertise).

- Most precise and defensible repricing.

- Acclaimed and court-tested legal expertise.

- Only indemnity captive, which transfers the risk of your high-cost claims to us and guarantees your savings.

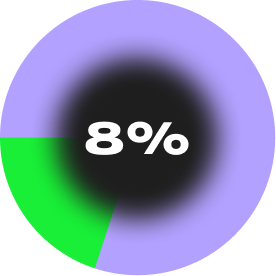

Classifications, Edits, & Audit™

Comp 42’s Classification, Edits, & Audit™ (CEA) system audits every fee schedule bill line by line, identifying errors, eliminating unnecessary charges, and ensuring you only pay for what’s fair—all while complementing PPO network discounts.

Additional Savings Beyond PPO Reductions

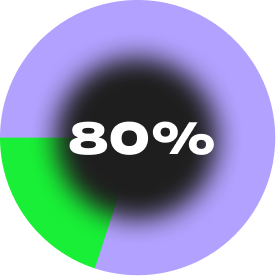

Usual, Customary, and Reasonable Repricing

Comp 42 offers specialized repricing services in Usual, Customary, Reasonable (UCR) states, focusing on bills not subject to state fee schedules. So why should you be paying a network access fee for a discount that doesn’t even save you money?

Up to 80% Savings off the Billed Amount

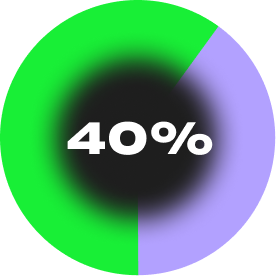

Stop Loss Outlier Inpatient Physician Review

Never before seen savings are now available in these fee schedule states.

Some providers in fee schedule states take advantage of outlier rules by using inflationary billing tactics to increase prices and secure higher payments.

Comp 42 exposes these overcharges and ensures the allowed charges are accurate, significantly reducing costs.

Up to 40% Savings off the Billed Amount

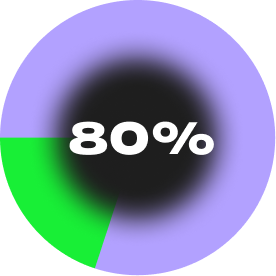

Air & Ground Ambulance Review & Repricing

Air and ground ambulance bills often come with hidden fees and exorbitant charges. Comp 42 spots unbundled charges and assesses transport services based on medical necessity, ensuring that every bill is accurate before payment is made.

Up to 80% Savings On Every Bill

Shield Indemnification™

Guaranteeing Our Recommended Payment Amount

Shield Indemnification™ protects carriers, plans, and members from the adverse impact of litigation expenses and balance billing tactics.

Shield Indemnification™ protects carriers, plans, and members from the adverse impact of litigation expenses and balance billing tactics.